Employees of Todd Corporation – MySuper

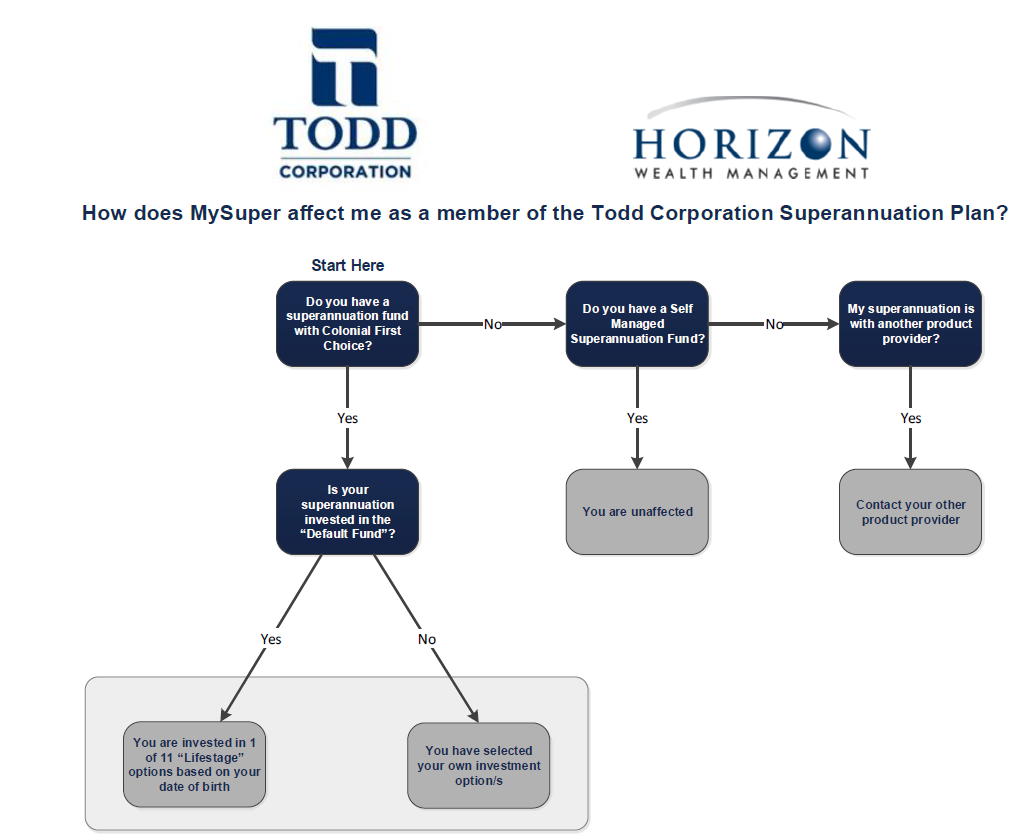

Employees who are not a member of the Todd Corporation Superannuation Plan through Colonial FirstChoice Employer Super ( CFS – FCES AND who have directed superannuation contributions to a Self Managed Superannuation Fund (SMSF) are unaffected and can ignore this communication.

Employees who are not a member of the Todd Corporation Superannuation Plan through CFS – FCES, AND who currently have employer superannuation contributions directed to an alternative Product Provider should contact that Product Provider in order to establish what actions may be required to be taken. This note is not relevant to your circumstances.

Colonial First State launched their MySuper Superannuation investment option on 11 June 2013 as part of their existing product known as Colonial FirstChoice Employer Super (CFS – FCES). All employer superannuation contributions post 11 June 2013 are affected.

CFS – FCES’s MySuper investment option is a Lifestage option. This is the Default Plan option with effect from 11 June 2013. There are 11 investment options automatically allocated based on your birth date.

|

Designed for people born within this five year age band |

Option Name |

|

1945 and 1949 |

FirstChoice Lifestage 1945 to 1949 |

|

1950 And 1954 |

FirstChoice Lifestage1950 to 1954 |

|

1955 and 1959 |

FirstChoice Lifestage 1955 to 1959 |

|

1960 and 1964 |

FirstChoice Lifestage1960 to 1964 |

|

1965 and 1969 |

FirstChoice Lifestage1965 to 1969 |

|

1970 and 1974 |

FirstChoice Lifestage1970 to 1974 |

|

1975 and 1979 |

FirstChoice Lifestage1975 to 1979 |

|

1980 and 1984 |

FirstChoice Lifestage1980 to 1984 |

|

1985 and 1989 |

FirstChoice Lifestage1985 to 1989 |

|

1990 and 1994 |

FirstChoice Lifestage1990 to 1994 |

|

1995 and 1999 |

FirstChoice Lifestage1995 to 1999 |

The new Investment menu came into effect on 11 June 2013.

Please note: Todd’s superannuation contributions will be allocated to Lifestages (if you are currently in the Default Fund) or your Chosen Fund.

Costs

|

Life Stage (Default) |

|

|

Total retail MER |

1.00% |

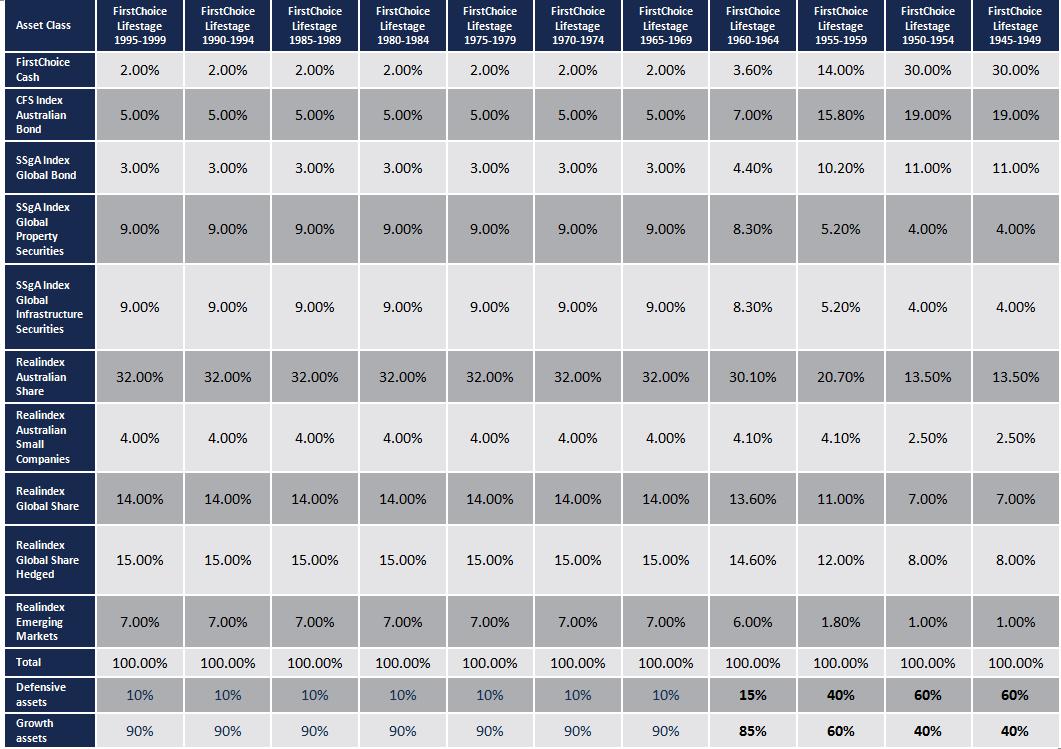

Comments on Asset Allocation:

- In the table below you will notice that in 7 of the 11 Lifestage options, the asset allocation is 90% Growth and 10% Defensive.

Asset allocation is a key consideration in fund selection and is dependent on your personal risk profile and risk appetite.

Can I select from any of the 11 Lifestage options?

If you do not wish your super contributions to be automatically allocated to a Default Lifestage fund based on your date of birth, you can select an alternative band which better suits your risk appetite. This can be done by completing an Investment Switch Form or doing a switch online.

What happens if I am not a current member of Colonial FirstChoice Employer Super and wish to join?

If you are an existing employee, you are required to complete a Superannuation Choice Form available from Alice.

All new contributions will then be directed into one of the new 11 default Lifestage options on CFS-FCES.

Please feel free to call Brian or myself if you have any questions, concerns or suggestions at anytime.

Brian May

phone: +61 2 9392 8700

email: brianm@horizonwealth.com.au

Kind regards

Alice Lim

General Advice Disclaimer

This document is not meant to replace or contradict the PDS (Product Disclosure Statement). You are advised to read the PDS should you wish to obtain the full meaning of any terms or benefits noted above.

This information was prepared by Horizon Wealth Management. It is of a general nature and does not take into account your personal investment objectives, financial situation or particular needs. You should assess whether this general advice is appropriate to your individual objectives, financial situation and needs. You can make this assessment yourself or seek the help of a professional financial advisor or taxation professional.